cash flow return on assets formula

Excluding cash equivalents less current operating liabilities ie. It is also sometimes known as cash return on cash invested.

Cash Flow Formula How To Calculate Cash Flow With Examples

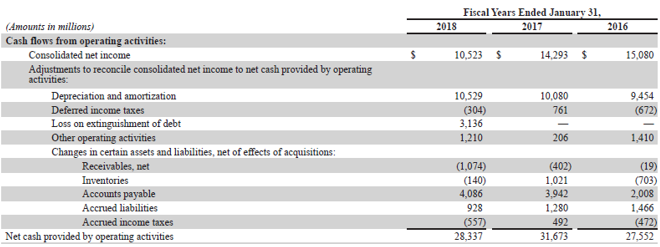

Cash flow from operations.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

. Hence Return on Net Operating Assets 02363 or 2363. Return on Net Operating Assets NI Net Operating Assets. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

Cash flow from operations Total average assets Cash return on assets. Sale Price Loan Balance Sales costs Income Taxes Original InvestmentCash Out of Pocket. Sales We can apply the values to our variables and calculate Cash Flow to Sales Ratio.

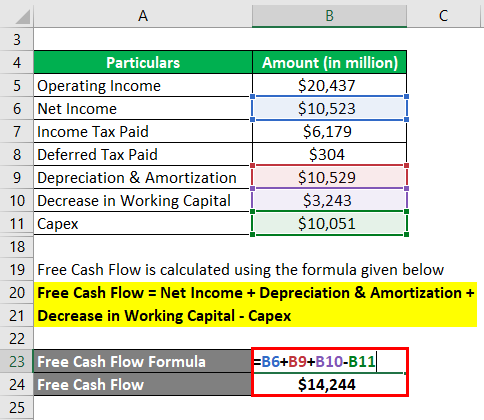

Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. Cash Ratio Cash. 250000 157419.

Example The cash flow to total asset. The RNOA figure provides useful insights into a companys ability to generate profits from equity resources. Cash flow based metrics are more important.

This is a cash flow based measure as opposed to earnings based metric. Cash Flow Return on Investment Operating Cash Flow Capital Employed. Now lets use our formula.

Rated the 1 Accounting Solution. Cash return on capital invested CROCI is metric that compares the cash generated by a company to its equity. As you can see to compute this ratio you merely take a companys cash flow which can be found on its statement of cash flow and divide it by its capital employed.

Net Working Capital NWC Revenue. C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Capital employed is a companys total assets.

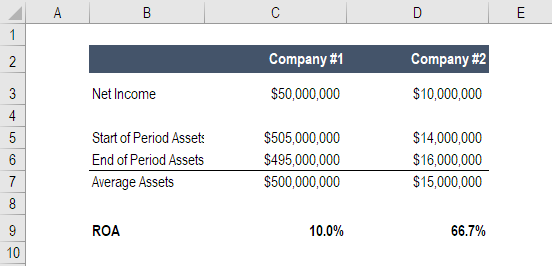

Net Return From Sale of Property. Cash Flow on Total Assets Ratio Formula. In other words ROA tells analysts how much each dollar of.

In this case Whimwick Studios would have a Cash Flow to Sales Ratio of 35 for 2019. Cash Return on Assets Ratio Formula Cash. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

Cash Flow to Sales 136200000 11600000 350400000. Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements. This means that the automaker generates a cash flow of 5 on every 1 of assets that it has.

Net working capital NWC is equivalent to current operating assets ie. Similar to Return on Total Assets the company hopes to generate as much revenue as possible from its assets. 500000 100000.

Now you can calculate your net proceedsreturn from the sale of the property. The equation for CFROI ratio is as follows. In the calculation the cash flow from operations figure comes from the statement of cash.

It is most commonly measured as net income divided by the original capital cost of the. The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets. Cash returns on assets cash flow from operations Total assets.

Comparing it with other automakers in the economy an investor can identify how are the growth prospects of the firm. Cash Flow Return on Investment is calculated using the formula given below CFROI Operating Cash Flow Total Assets Total Current Liabilities. Return on Assets frac Net Income Total Assets Return on Assets T otal AssetsN et I ncome.

Sam spends 1500 on a bare. It distinguishes the financial and investment income from the operating income. Return on Assets ROA is a type of return on investment ROI ROI Formula Return on Investment Return on investment ROI is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost.

The measure is usually derived in aggregate for an entire business in which case the calculation is to divide the total average assets into the cash flow from operations. The Cash Return on Assets measures the Cash Flow from Operations in relation to Total Assets. For example pretend Sam and Milan both start hot dog stands.

Ad QuickBooks Financial Software. Assets The total average assets are obtained by summing the value of total assets at the beginning and the end of the period and dividing the result by 2. The formula is as follows.

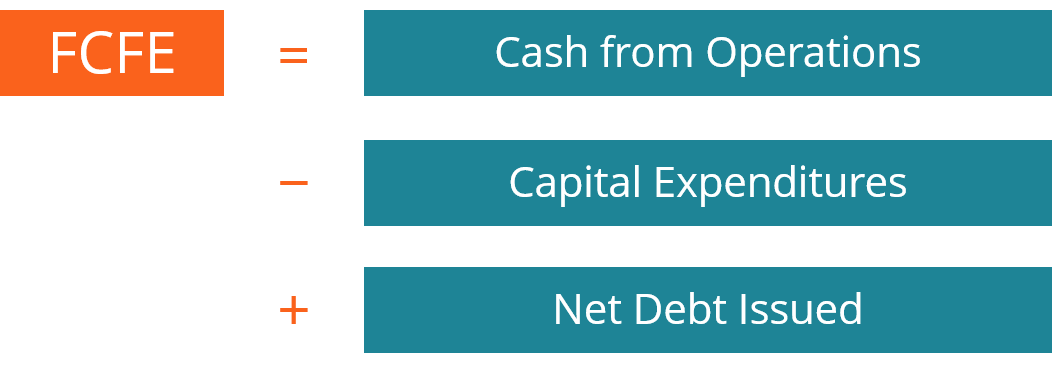

It compares the cash earned with the money invested. Cash returns on Assets Cash Flow from Operations Total Assets Total Assets includes all assets and not just limited to the fixed assets and can be calculated directly from the balance. Cash Flow Return on Investment formula CFROI Formula Operating Cash Flow OCF Capital Employed To be able to calculate CFROI we need to understand both OCF and CE.

The Cashflow Return on Assets is a profitability metric that measures how efficiently a company uses Assets to generate Operating Cashflows. Cash Return on Assets basically shows how well or how poorly the company is generating cash from its asset investments. Cash Returns on Asset Ratio 5.

It is calculated by dividing Operating Cashflows by the Asset position on the balance sheet at the beginning of the financial period. Net income Total average assets Cash return on assets The answer tells financial analysts how well a company is managing assets. The measure is usually derived in aggregate for an entire business in which case the calculation is to divide the total average assets into the.

Cash Flow on Total Assets Ratio Formula. ROA Formula Return on Assets Calculation. Is the net cash flow from operating activities in the statement of cash flow.

Free Cash Flow Formula Calculator Excel Template

Cash Flow Per Share Formula Example How To Calculate

Financial Ratios Calculations Accountingcoach Financial Ratio Debt To Equity Ratio Financial

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow Efinancemanagement

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Return On Assets Roa Formula Calculation And Examples

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

Operating Cash Flow Formula Calculation With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Cash Flow Formula Calculator Examples With Excel Template

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Free Cash Flow Valuation Online Presentation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)